Hospital Posturing on Finances Obscures Grave Crisis of Health Care Affordability

October 16th, 2023

As the Continuing Resolution expires and Congress is under increasing pressure to fund the government and reauthorize expiring programs, the American hospital industry continues to paint a lurid picture of U.S. hospitals’ financial health, warning patient access could be compromised without immediate legislative intervention. To hear the American Hospital Association (AHA) tell it, the “vast majority” of America’s hospitals are in serious financial jeopardy due to workforce shortages, rising labor costs, broken supply chains and rapid inflation.

It’s true many smaller hospitals serving rural and disadvantaged populations are suffering post-pandemic financial hardship, and targeted policy solutions are essential to ensure their sustainability. But for the country’s larger health systems, the situation is hardly as bleak as advertised. The industry’s tale of financial woe is fundamentally misleading and omits critical details about hospital funding and performance. It also distracts from the very real and increasingly grave crisis surrounding health care affordability being experienced by the nation’s employers and their employees and families.

Subsidies Help Fuel Industry Consolidation

It’s worth remembering that the hospital industry has already received more than $170 billion in COVID-19-related government-authorized assistance. These subsidies helped preserve near-normal profit margins through the worst of the pandemic, despite sharp declines in operational results. Hospitals also benefited from an estimated $100 billion in low-interest loans and enjoyed a 20% boost in Medicare reimbursements for inpatient COVID-19 admissions.

What the industry doesn’t mention in its pleas for additional funds is that the earlier, no-strings-attached COVID subsidies were used by many of the country’s most well-heeled health systems to support acquisitions of weakened competitors and physician practices, not to address pandemic-related operational issues. These deals marked a continuation of a pre-COVID-19 trend that saw larger systems snap up smaller players in pursuit of expanded market share, reduced competition and higher prices and profits.

The flurry of consolidation and integration continues unabated. Merger and acquisition activity in the industry – a marker of the largest health systems’ overall financial health – hit record-high levels in the second quarter of 2022, with 13 transactions generating $19.2 billion.

Another important piece of evidence that reflects hospitals’ true economic condition is the disconnect between what the industry is telling policymakers on one hand and what for-profit systems are telling investors on the other. Tenet Health, for example, bragged in a Q2 2022 earnings call that margins or earnings before interest, taxes, depreciation and amortization (EBITDA) for its United Surgical Partners International subsidiary were a remarkable 41%, while surgical cases had reached 100% of pre-pandemic levels.

Surgery Partners, a publicly held ambulatory surgery company, saw net revenue increase by 11% to $1.6 billion through the worst of the pandemic, from 2019 to 2021, and predicts the ongoing migration of surgical procedures from inpatient to outpatient settings will continue to fuel rapid growth going forward.

Bailouts for Negative Market Returns?

Despite these bullish indicators, industry representatives declared last fall that two-thirds of hospitals could be operating at a financial loss in 2022 due to post-pandemic pressures. Tellingly, however, a key component of hospitals’ losses was not discussed.

A recent study of quarterly financial statements from 10 of the nation’s largest non-profit hospital systems provides a more complete accounting. The analysis confirmed that, on average, the 10 non-profits experienced a reversal in profit margins from 9% in 2021 to minus-6% in 2022.

Yet a closer look at the numbers showed the vast majority of the red ink stemmed not from operations (the systems’ patient care revenue actually increased by 1%) but from declines in investment income. All told, the 10 systems experienced an 185% drop in investment income, accounting for 85% of total losses.

Should the American taxpayer bailout hospitals for making bad bets in the stock market? Petitioning taxpayers to help recoup poor investment outcomes is a brazen and unacceptable attempt to evade responsibility for flawed business decisions. It’s also a testament to hospital hubris, given that it’s an appeal few, if any, other industries or businesses would contemplate.

Stingy Charity Care

Even with their investment reverses, America’s non-profits – which represent about 58% of all hospitals — continue to reap tax avoidance subsidies collectively worth about $60 billion annually. In return, they’re obligated to provide community benefits, which typically take the form of charity care, or free or discounted care for poor patients who couldn’t otherwise afford it.

It’s true some non-profit hospitals provide community benefits that are equal to, or in excess of, the tax breaks they receive. Nonetheless, increasingly restrictive financial aid policies imposed by larger systems have helped drive the overall value of the U.S. charity care to miniscule levels.

A 2022 analysis by the Wall Street Journal found that U.S. non-profits spent, on average, just 2.3 cents of every dollar of patient revenue on charity care in 2021, with many providing less than 1%. Surprisingly, the average amount spent by non-profits was less than the 3.4% provided by their for-profit competitors.

Non-profit Henry Ford Health in Detroit is currently undertaking a $2 billion facility renovation, its largest ever, with the hope of becoming a recognized destination for patients traveling for care. Yet the company’s spending on community benefit locally declined from 1.9% in 2010 to just 0.73% in 2019.

Several state legislatures are pursuing laws that would establish new hospital community benefit reporting and spending requirements at the state level. Don’t hold your breath that the Internal Revenue Service will take non-profit providers to task. A lack of enforcement resources and broad flexibility in how hospitals are allowed to apply their community benefits suggests few, if any federal repercussions for the paltry level of charity care.

Oceans of Waste

One final area of hospital economics that the industry is unlikely to share with policymakers or the public is the extent of waste across the health care system. A landmark study in 2019 estimated that between 20-25% of all health care spending is wasteful, with administrative costs representing the largest piece at about 35% of the total. Other contributors include fraud and abuse, failure of care coordination, overtreatment or low-value care and pricing failure.

Instead of continually relying on higher prices and more government funds to shore up their finances, hospitals should focus on increasing efficiencies, lowering costs and eliminating waste. This is, after all, what virtually every other business is compelled to do.

Employer Sponsored Health Coverage in Jeopardy

For hard-pressed employers, workers and their families, it’s painfully clear that the real emergency in health care has little to do with hospitals losing money. It’s about patients being stretched to the breaking point by rising health care costs and about the increasingly uncertain future of employer-based health benefits.

U.S. health care now devours $4.3 trillion a year, or $12,900 for every man, woman and child in the country. Hospital prices alone have soared 600% since 1990 and hospital services now represent the largest share of total health care costs at about 37% of the total for privately insured Americans. For many Americans, the costs have become prohibitive: Nearly half of Americans say they’ve avoided getting health care services because of cost worries and nearly two-thirds of personal bankruptcies have been linked to medical expenses.

Just as alarming, nearly 90% of executives at 300 of the country’s largest employers have warned the cost of providing health benefits will be unsustainable within five-to-10 years. Given that nearly half of all Americans rely on employer-based health coverage, it goes without saying that the loss or severe diminution of these benefits would be catastrophic.

Preserving an Affordable System of Care

The harsh truth is that the unbridled pursuit of profit has come to dominate most aspects of American health care, and employers and patients are paying the price. To ease the crisis, it’s imperative that policymakers take a number of critical steps, including enforcing full price transparency to foster real competition among hospitals and other providers, strengthening anti-trust enforcement and oversight of mergers and acquisitions, developing more effective performance measures to assess what outcomes the system is actually producing and implementing payment reforms that will incentivize changed provider behavior.

These are just some of the actions that will be necessary to ensure and sustain affordable, equitable and high-quality health care system. What is most assuredly not needed, and what will only serve to exacerbate the crisis, is to continue funneling enormous amounts of money into America’s dissembling and dysfunctional hospital industry.

Employees Ready for Action to Address High Health Care Costs

August 29th, 2023

For years, employees have faced increasing premiums and cost-sharing. But how well do they understand the sources of those increases, and how ready are they for employers or policymakers to take action?

Recent focus group research conducted by Public Agenda, a nonpartisan research-to-action organization, with people covered by employer-sponsored insurance, found that participants were unaware of the extent to which provider prices are driving the affordability crisis. But when focus group participants were presented with straightforward information about the drivers of high medical costs, they favored government price-regulation and backed preventing anti-competitive mergers among hospital systems. By contrast, they were concerned about how changes to benefit design, such as tiered or narrow networks, would impact access and quality.

This research, supported by Arnold Ventures, convened 40 adults covered by employer-sponsored health insurance in Texas, Washington State, Wisconsin, North Carolina and Pennsylvania.

“We gave employees in these focus groups the opportunity to deliberate over various approaches to addressing high provider prices,” said David Schleifer, PhD, Vice President and Director of Research at Public Agenda. “Even participants who said they were wary of government regulation felt that price regulation has become necessary because prices have gotten out of hand.”

Confusion About Key Cost Drivers

Focus group participants initially assigned blame for rising costs to insurers, pharmaceutical companies and the effects of inflation. They were surprised when presented with data showing that hospital, physician and clinical services accounted for 51% of $4.1 trillion in total U.S. health care spending in 2020.

When they were shown data that indicated health care providers’ prices rose by almost 16% between 2016 and 2020, they cited widespread corporate greed as the underlying cause for sharply rising hospital and physician price increases.

Support for Price Regulation and Limitations on Hospital Mergers

Employees in these focus groups were strongly supportive of either state or federal government playing a role in setting health care provider prices and limiting hospital mergers. Broadly speaking, participants saw government regulation as a way to make pricing more reasonable and predictable. And they believed that anti-trust enforcement could break up monopolies and shield patients from what they framed as price gouging. This mirrors the views that employers expressed in a survey of more than 300 executive decision makers conducted by PBGH and the Kaiser Family Foundation (KFF).

The lack of functional and effective markets in the private health care system is driving the out-of-control health care costs too many Americans face. Effective markets require healthy competition among providers, health plans, drug manufacturers and suppliers. Also essential is transparent information on quality, patient experience, health equity and meaningful choices for consumers. Unfortunately, these conditions are not met in all markets.

Employers Pay Lion’s Share of Premiums

According to KFF, employers paid 73% of family premiums in 2022. But employees in these focus groups didn’t realize that employers typically pay the bulk of health insurance premiums, including those for family coverage. When presented with the data, however, participants could easily see how these high premiums must affect employers’ competitiveness and employees’ compensation.

The employers footing the bill for rising premiums also express significant concerns regarding health care costs. The PBGH and KFF survey of executive decision makers found 83% agreed that the cost of health benefits is excessive. Additionally, 87% believed that the cost of providing health benefits to employees will become unsustainable in the next five to 10 years.

Perspectives on Benefit Design

When presented with three benefit designs that employers could use to mitigate high provider prices – reference pricing in which prices are set based on a percentage of what Medicare pays for medical services; tiered networks based on cost and quality; and narrow networks that do not cover low value providers – these employees consistently preferred reference pricing over tiered or narrow networks.

They believed reference pricing could preserve access to more hospitals and networks than tiered or narrow networks. Among their concerns, however, was the possibility that hospitals and doctors could refuse patients whose insurers used reference pricing. They also worried that if hospitals and physicians earned less money, they would have less incentive to provide high-quality care and that talent could abandon hospitals being paid via reference-pricing in favor of wealthier facilities.

Employees were skeptical of how both tiered and narrow networks would affect access to care and quality. They noted that these models could make care more expensive for people unable to travel to preferred providers, a reality that would exacerbate already-limited access in low-income communities, communities of color and rural areas. Employees also expressed distrust about insurers’ ability to fairly determine which hospitals or doctors provide high-quality care. They believed insurers would use tiered and narrow networks to drive people toward inexpensive, but not necessarily high-quality, care and would not prioritize patient needs.

Open, ongoing dialogue with employees about the drivers of high health care costs and different ways of addressing them can help employers, policymakers and advocates better understand the views, priorities and concerns of people with employer-based insurance.

Learn more about Public Agenda’s focus group findings. Public Agenda’s research was supported by Arnold Ventures.

High Health Costs Hurting Employers’ Ability to Hire and Keep Workers

January 3rd, 2023

A new survey of U.S. employers underscores the widening damage done by rising health care costs: Nearly 75% of those surveyed say health care expenses are squeezing out salary and wage increases and more than 80% believe health costs are negatively impacting their ability to stay competitive in today’s labor market.

The Pulse of the Purchaser survey, conducted online in August and September by the National Alliance of Healthcare Purchaser Coalitions, assessed employer views on health care and the workplace environment. Respondents included 152 employer-members of organizations affiliated with the National Alliance. The purchasers represented an array of sectors and ranged in size from more than 10,000 employees to less than 1,000.

‘A Street Fight’

Michael Thompson, National Alliance president and CEO, said the survey results bring into sharp relief the growing challenges employers face in recruiting and retaining talent amid a volatile labor market and the unrelenting financial burden of health care.

“The consensus among many of the responding employers is that attracting and retaining employees has become a street fight,” Thompson said. “Concerns about a recession and runaway inflation make it even more critical that employers are able to hire and keep top talent and getting unreasonable health care costs under control has a far-reaching impact on wages and ability to compete.”

The survey found that post-pandemic, finding and keeping employees has become an even higher priority for nearly 80% of employers, with 100% agreeing that health and wellbeing benefits are essential to effective hiring. Rising health care costs also remain a significant concern for employers, with the biggest cost drivers of employer-sponsored health benefits coverage for employees and their families being drug prices (93%), high-cost claims (87%) and hospital costs (79%).

Ninety-seven percent of respondents believe hospital prices are unreasonable and indefensible, and 93% say hospital consolidation has not improved the cost or quality of services. Additionally, employers familiar with transparency tools such as those from RAND, National Academy for State Health Policy and Sage Transparency are up to 10 times more likely to strongly disagree that hospital prices are reasonable and defensible.

Hospitals Continue to Seek More Money

The results of this survey come at the same time the hospital industry – a primary source of rising health care costs in the U.S. – is asking Congress to stop scheduled Medicare payment cuts and provide more federal relief due to challenging economic conditions. But a recent analysis of SEC filings by the Kaiser Family Foundation found that the nation’s three biggest for-profit hospital chains each had positive operating margins that exceeded pre-COVID levels for most of the pandemic, including as recently as the third quarter this year.

In short, the industry continues to cry hungry with two loaves of bread under its arms.

Strategies to Lower Costs

Almost half (47%) of employers, according to the Pulse of the Purchaser survey are using centers of care excellence; within the next three years, many others are looking at tiered networks (46%), sites of care (43%), contracting and performance guarantees tied to Medicare pricing and reference-based pricing (36%).

More than 90% of employers say they have implemented or are considering high-cost claims management, mental health and substance use access and quality, hospital quality transparency, hospital price transparency and whole person health.

Employers are open to a range of policy and regulatory remedies, including drug price regulation (82%), surprise billing regulation (79%), hospital price transparency (76%) and hospital rate regulation (72%).

States are also sending a strong signal that providers need to compete on value and will no longer be allowed to engage in anti-competitive practices to gain market power. In states as varied as California, Washington, Texas and Indiana, state lawmakers are working to eliminate anti-competitive contracting practices and increase transparency around pricing, quality and costs.

The Influence of the CAA

At the federal level, the landmark Consolidated Appropriations Act of 2021 (CAA) requires plan sponsors be given access to new and critically important health care pricing information. At the same time, it imposes fiduciary obligations for employers who self-insure under the Employee Retirement Income Security Act of 1974 (ERISA).

Under the law, self-insured employers will need to demonstrate that the health care services they buy for employees are cost-effective and high-quality. That means they must take steps now to ensure appropriate oversight procedures are in place that will enable them to document their efforts to comply with CAA’s provisions. It also means that employers will increasingly have access to new and critically important insights into the prices they’re paying for employee health care services – details they have been unable to previously obtain from vendors to whom they pay millions of dollars each year to negotiate on their behalf.

No Surprises Act Facing Continued Pressure from Providers

December 15th, 2022

In the courtroom and in the field, provider interests are continuing their full-court press to undermine elements of the No Surprises Act, the landmark federal legislation enacted earlier this year to shield patients, payers and purchasers from exorbitant and unexpected out-of-network medical bills.

On Sept. 22, the Texas Medical Association filed a new lawsuit to block portions of the act’s final rule. The action followed an earlier legal challenge by the association that resulted in substantial modifications to the arbitration process at the core of the No Surprises Act.

Separately, provider organizations nationwide continue to submit arbitration requests related to the No Surprises Act with new payment disputes in numbers that could conceivably overwhelm the nascent system.

These actions underscore the determination of some hospitals and physician groups — particularly those backed by private-equity firms that rely on the outsized margins produced by out-of-network charges — to preserve the status quo by favorably influencing and/or destabilizing the way charge disagreements are settled.

Early success in protecting patients

The No Surprises Act, which took effect January 1, 2022, shifted the burden of covering out-of-network bills from patient to health insurer. Out-of-network providers are now prohibited from billing patients covered by private insurance an amount greater than the in-network rate for the same service. Instead, they must work with the patient’s insurer to arrive at an agreeable price.

The law was designed to end the egregious practice of subjecting patients to unexpected and often financially devastating charges for out-of-network care, most frequently related to emergency care.

Early evidence suggests the act is having an impact. A recent survey by the national health insurer association, AHIP, and the Blue Cross Blue Shield Association estimated more than nine million potential surprise bills were prevented since January 2022 due to the implementation of the No Surprises Act. Should the trend hold, more than 12 million surprise bills will be avoided this year alone.

Legal challenges

The recent lawsuit by the Texas Medical Association, like its initial complaint filed late last year, seeks to alter the process by which arbitrators calculate payments to resolve disagreements between health care providers and insurers. Specifically, the lawsuit aims to reduce reliance on a region’s median inpatient rate currently used to determine a fair price for services under dispute. Known as the qualified payment amount, or QPA, providers have criticized these rates as deflated, opaque and determined solely by health plans.

In February, a federal judge in the Eastern District of Texas agreed with the

medical association that the federal agencies responsible for implementing the No Surprises Act — the departments of Health and Human Services, Labor and Treasury — had erred in instructing arbitrators to give extra weight to the QPA. Consequently, the act’s final rule released August 19 contained significant modifications, most notably a downgrade of the QPA’s role in determining renumeration. The QPA is no longer the central, presumptive amount for achieving an equitable price, but merely a starting point that can be further influenced by other factors.

The most recent Texas Medical Association suit essentially argues that the agency didn’t go far enough in diluting the role of the QPA and that the median rate continues to represent an “unmistakable thumb on the scale” when it comes to resolving disputed charges.

Flooding the zone

PBGH and others have argued that downgrading the role of the QPA will likely result in wide variation in arbitration outcomes since it will force individual arbitrators to exercise their own judgment when considering factors as disparate as market rates, clinician training and experience, facility teaching status and whether participants engaged in good faith efforts to resolve disputes.

Supporters of the original legislation’s language contend that a lack of arbitration predictability will lead to a greater use of the dispute resolution process as parties “shop” for arbitrators most likely to rule in their favor. While it’s too early to know the extent of settlement variability, it is clear that the volume of disputed cases is rising rapidly.

Since the April 15 go-live of the act’s independent dispute resolution process, more than 275,000 disputes were initiated. That’s substantially more than the 17,000 the government had previously estimated would be filed in an entire year, and anecdotal evidence suggests the number of new disputes continues to grow.

In recent letters to the heads of the agencies responsible for implementing No Surprises Act, the Coalition Against Surprise Medical Billing noted that the independent dispute resolution process was designed to “be used sparingly as a backstop in unique cases where the plan and provider cannot reach an agreement on what constitutes a fair reimbursement.”

That is clearly not what is happening.

The letters also urge the agencies to stay the course and closely monitor both the volume of arbitration cases and their outcomes to ensure the No Surprises Act lowers costs as intended.

Ongoing vigilance

Going forward, PBGH, its allies at the Coalition Against Surprise Billing and others will continue to closely monitor the implementation of the No Surprises Act with an eye toward the possibility of further influencing future rulemaking to ensure the act achieves its objectives of ending surprise billing and holding down health care costs for patients and purchasers.

5 Policies to Create a Fair Health Care Market

March 30th, 2022

This week, actuaries with the Centers for Medicare and Medicaid projected health care spending will grow to reach almost $6.8 trillion by the year 2030 and consume nearly 20% of the country’s gross domestic product, or one in every five dollars spent. A significant portion of that spending is paid by private and public employers, which in turn, acts as a drag on both business growth and household incomes.

As innovative employers seek market solutions to wrangle health care costs while improving the quality of care they offer working Americans, they also recognize that the government has a role to play in ensuring they have a functional marketplace in which to purchase health care on behalf of their companies and employees. They have been eager to see action on the part of the Centers for Medicare and Medicaid Services (CMS) Innovation Center and Health and Human Services to help tamp down the ever-climbing health care costs that come out of their budgets – action they have yet to see.

Here are five policy areas employers want to see implemented.

1. Addressing Market Consolidation and Anti-Competitive Practices

Health care system consolidation is not a new problem, but it has gained attention over the past several years, particularly in light of a slew of megamergers proposed during the COVID-19 pandemic. In an executive order signed in July 2021, President Biden directs the Department of Health and Human Services to move forward with price transparency requirements, and directs the Department of Justice and Federal Trade Commission (FTC) to review and revise guidelines for challenging future consolidation by health systems. New guidelines would make it more likely that the FTC will intervene to stop anti-competitive mergers among health systems, improving the competitive landscape and combating rising health care costs that land on employers and other large purchasers, as well as consumers.

In addition, Congress should prohibit anti-competitive practices that have enabled some health systems to gain market power and raise prices. These practices have included anti-tiering and other contract terms that were the target of a successful lawsuit against Sutter Health System in California. The Healthy Competition for Better Care Act (S 3139), a bipartisan bill introduced by Senators Braun and Baldwin, would take on these practices. Federal legislation is also needed to prohibit drug manufacturers’ practices such as “patent evergreening” and other “patent thickets” to ensure that branded products will face healthy price competition from generic drugs and biosimilars in line with the intent of current laws.

2. Universal “Site Neutral” Payment

Medicare, along with other payers, often pay substantially more for the same care if it is delivered in a hospital outpatient department, rather than in a physician’s office, even when the service is identical. The higher payment rates put independent physician practices at a disadvantage and encourage more industry consolidation. What’s more, the higher prices charged by practices owned by a hospital system tend to be hidden from patients, causing unexpected – and often excessively elevated — out-of-pocket costs.

Universal site-neutral payments – the same pay for the same service — would save the health care system more than $350 billion (and as much as twice that) if adopted by all payers. It would also balance the playing field for independent physician practices.

3. Support for Physician-Led Accountable Care Organizations and Alternative Payment Models

All the evidence suggests that physician-led Accountable Care Organizations and alternative payment models, including those that pay clinicians prospectively to manage patient care, are more successful than hospital or payer-led models. Large employers and purchasers are interested in seeing CMS take an active hand in promoting these efforts. Policymakers can support the success of physician-led ACOs by helping them create the infrastructure needed to take on financial risk, invest in high-value care and develop partnerships with other organizations to provide comprehensive care. This includes providing financial incentives for quality performance to encourage providers to redesign care to improve health outcomes. CMS and leading payers need to communicate clear outcomes objectives and attach significant rewards and penalties providers’ performance.

In addition, a recent PBGH survey of large employers found that nearly six in 10 see low investment in primary care as a barrier to better employee health. Roughly 90% said they would be in favor of reallocating funds to primary and preventative care. One way to finance this effort, which employers would like to see CMS support, is to redirect money paid to health plans for care coordination to physician practices engaged in advanced primary care.

4. Renewed Push for Build Back Better – Including Prescription Drug Price Relief

President Biden’s nearly $2 trillion Build Back Better (BBB) proposal included provisions on drug pricing, but the effort was stymied. On Jan. 19, 2022, President Biden suggested in a press conference that the Senate would break the BBB bill into pieces, attempting to pass provisions that have support of all 50 Democratic Senators.

The current legislation would allow Medicare to negotiate on the price of certain high-cost sole-source drugs after their patent and market exclusivity periods have expired. It would also impose strict inflation caps on all high-cost sole-source drugs. Importantly, those inflation caps would apply to all purchasers, not just Medicare. If enacted, this provision would save employers, other health care purchasers and consumers tens of billions of dollars over the next decade.

5. Holding Drug Makers and Third-Party Organizations Accountable for Drug Prices

Policymakers have been looking at opportunities to increase transparency and accountability of pharmacy benefit managers (PBMs) and others in the drug supply chain. The Trump Administration’s Transparency in Coverage rule, which is being implemented by the Biden administration, albeit on a somewhat delayed timeframe, includes significant new drug price transparency requirements of health plans and PBMs. Not surprisingly, the Pharmacy Care Management Association (which represents PBMs) has sued the administration to stop implementation of certain sections of the rule. If implemented, the rule would require PBMs to report on negotiated rates and historical net prices for covered prescription drugs. Combined with the Consolidated Appropriations Act (CAA), which ultimately requires PBMs to provide the information employers need on prescription drug spending to meet their obligations under the law, would be impactful.

Importantly, no explicit statutory authority exists for policymakers to regulate PBMs directly. What is needed is for policymakers to establish direct oversight authority for PBMs in all markets. AND we need PBMs to be held to the same fiduciary standards that self-funded employers are held to. Only then will we get the accountability we need.

Price Transparency Offers Opportunity to Employers and Purchasers

November 10th, 2021

What is hospital price transparency?

A landmark federal rule requires the nation’s 6,000 hospitals to make pricing data available publicly. This requirement includes plan-specific negotiated prices, not just the “chargemaster” prices, for every item or service.

The rule was supposed to help consumers and purchasers shop more intelligently for health care services. However, due to variable compliance and huge discrepancies in how the data is presented by reporting hospitals, it has been difficult to benchmark or compare data across hospitals.

Why haven’t hospitals complied?

Hospitals that have been slow to comply with the transparency rule have faced a penalty of only $300 per day. This is a very small financial hit to hospitals – large or small.

In early November, the administration finalized a rule to increase to the penalty that takes hospital size into account, raising penalties as high as $2 million a year for large hospitals that fail to make prices public. This increase in penalties will go into effect in January 2022.

What does this mean for employers?

Employers can use this information to drive value-based purchasing.

Employer Opportunities:

- As data becomes more complete over time, price information can be used to structure requirements in the procurement process and negotiate better contracts.

- Better price information will give employers and other health care purchasers more insight into how their contracted hospitals compare on price with other hospitals, both overall and on an item-specific basis.

- The availability of specific price information allows for better consumer decision support tools, more member engagement and better member education.

Health Plan Opportunities:

- Health plans will be able to use the data to negotiate better contracts with providers.

- Price data can also be used in conjunction with quality and patient safety ratings to design benefits that support the use of high-performing, lower-cost providers.

- Networks can be designed based on value, and variation that does exist will be easier to identify.

Bottom Line: Price transparency means health care purchasers have access to more information to determine value and improve affordability for their employees and members.

COVID-19 Offers a Chance to Course Correct the Health Care Industry

September 22nd, 2021

The COVID-19 global pandemic and resulting economic slowdown had profound impacts on many sectors, including tourism, aviation, oil, finance and health care.

In the U.S., the virus continues to take its toll; people are once again urged to get vaccinated, wear masks and take other precautions. Some companies are further delaying plans to return to the office – threatening the recovery of these markets.

In the 40 years prior to the pandemic, all these industries have experienced previous economic corrections or crises – except for health care. The word crisis originates from a Greek word meaning a point at which change must come. In that vein, recovering from the COVID-19 crisis presents an opportunity to reset and change our baseline for health care.

Health Care Has Become Unsustainable

The U.S. health care system has become unaffordable and unsustainable for the average American and the employers who provide health benefits to 60% of Americans. As we work to recover from the massive toll the pandemic has taken on our physical and financial health, we must take this opportunity to develop a more adaptable, streamlined and efficient system.

Because our health care industry has previously been insolated from economic hardship, its infrastructure has grown exponentially with little focus on productivity or quality improvements. Overhead has ballooned, and minimal constraints have been placed on pricing.

Industry consolidation has only made matters worse resulting in a concentration of economic power with no counterbalancing oversight or control. Lack of transparency and accountability, incentive misalignment and price gouging have become all too commonplace. This would be unacceptable in any other industry with functional market forces.

The Sutter Health decision offers a case study of a health system using its market power to extract favorable and indefensible contract terms from employers, employees and their families. The RAND hospital transparency study demonstrates that these pricing inequities are common place.

COVID-19 Shines a Spotlight on the Need for Change

COVID-19 has turned the health care system on its head. Capacity of the system has been strained like never before, while at the same time preventive care and screenings have decreased and virtual care has increased exponentially. The pandemic has laid bare the challenges of our health care system, while presenting opportunities to accelerate long overdue economic corrections and quality improvements.

Sustaining these critical services is essential, but we must invest more in primary care to meet the diverse needs of all Americans. We must require transparency, accountability and oversight to curb future growth in hospital spending. And we must remove barriers to sustaining the growth in virtual care options while capturing the efficiencies and standardized performance improvement opportunities virtual care offers.

At the same time, we must also invest more in the quality and capacity of mental health and addiction services and demand accountability for reducing inequities when it comes to access and care.

We have an opportunity to build back a better system together. This requires industry stakeholders, including health system administrators, policy makers and employers, to work together to build an affordable, accessible and quality health care system. Our country, our communities and our people deserve nothing less.

U.S. Employers Sacrificing Competitiveness in the Global Economy

September 7th, 2021

Health care as an industry has become big business at the expense of employers and employees. With 60% of Americans getting their health care coverage through their jobs, large and small employers alike are justifiably concerned about rising costs of care.

The current health care delivery system is long overdue for change. No meaningful transformation can occur without a collective employer voice. Until now, the majority of CEOs and CFOs have remained a silent majority. The time to speak up is now – we are sacrificing our competitiveness in the global economy by paying so much more than needed for health care and health system sustainability.

The proof is in the numbers.

The ongoing RAND Hospital Pricing Transparency Study continues to show that employers routinely pay two-to-five times more than what is needed for health care and prescription drugs. RAND also confirms there is little correlation to the quality of care received and prices paid for those services.

Quality not only includes providing the best evidence-based care, but also avoiding unnecessary tests, procedures and surgeries. A recent report on hospital waste and overuse on more than 3,100 U.S. hospitals from the Lown Institute, a nonpartisan health care think tank, found that in Houston alone several hospitals ranked in the bottom 50. The National Academy for State Health Policy shows a widening gap between what employers pay and what is needed for hospital mission sustainability.

The old argument from hospitals is employers must be charged excessively because of inadequate reimbursement from other payors. The truth is most U.S. hospitals make a profit from Medicare and/or Medicaid. Additionally, the rise in premiums paid by employers and their employees is not due to utilization but to inflated prices, and that added revenue is going more towards administrative costs and facility fees, not to physicians and better health care.

Why should I care?

High health care costs are a drain on job and wage growth and business development, all of which impedes the ability of American companies to compete globally.

Most CEOs consider employees to be their greatest asset, yet employee quality of life is slowly eroding. Funds previously earmarked for salary raises are now being used to support rising employer premiums, resulting in greater costs to employees. Additionally, high deductible health plans force many employees to forego needed medical care resulting in even higher costs for delayed care. Recent studies show a laundry list of issues for employees due to unaffordable health care, including saving for children’s education and a looming retirement crisis.

As a benefits director for a large company recently shared, “Our business and our employees are being crippled by health care.” This current system penalizes employees with smaller paychecks and higher burdens. Where’s the value in that?

In response, C-suite leaders are beginning to react to evidence of egregious employer price discrimination such as that identified in California by the recent Sutter Health litigation. Increasingly, they’re unable to look away from the direct relationship between anti-competitive business practices of the health care industry and rising costs that threaten their business and their employees’ financial and physical well-being. Perhaps that’s why a recent survey of executives at 300 of the country’s largest companies found that nearly 90% of believe the cost of providing health benefits will be unsustainable within five-to-10 years, and that one viable option for saving the system is some kind of new intervention by the federal government.

What can I do about it?

Few CEOs would knowingly pay such inflated prices for any other element of their business supply chain, yet they continue to foot an exorbitant bill for health care, which is no different than any other service or product they purchase for their business.

It is time for C-suite leaders to take action on behalf of their business, their employees, their city and their country. It’s time to step up and demand change and accountability, which can only come from a collective C-suite voice.

Known solutions exists. We must eliminate the inefficient and wasteful system focused on disease that prioritizes tests and procedures. It needs to be replaced with a focus on advanced primary care with referral to specialists based on value that also emphasizes the importance of mental health services. We must reduce the outrageously high prices Americans pay for drugs compared to the rest of the world and reduce the price discrimination faced by those with private health insurance paying roughly 300% what Medicare pays for the same services.

Some health care industry players have benefited greatly from the status quo at the expense of employers and are openly resistant to change. The tools, data and information needed to demand a value-based health care system are now available to employers and their intermediaries. Those best positioned to drive this needed transformation are employers, but it will not happen without C-suite engagement and resolve.

Vertical Integration Isn’t Great for Health Care Consumers or Purchasers

August 23rd, 2021

In 2017, pharmacy giant CVS announced its purchase of insurer Aetna for $69 billion in the largest-ever health care merger. This is just one example we have seen in recent years of the acceleration of acquisitions combining traditionally independent elements of the health care supply chain.

Problems posed by vertical integration

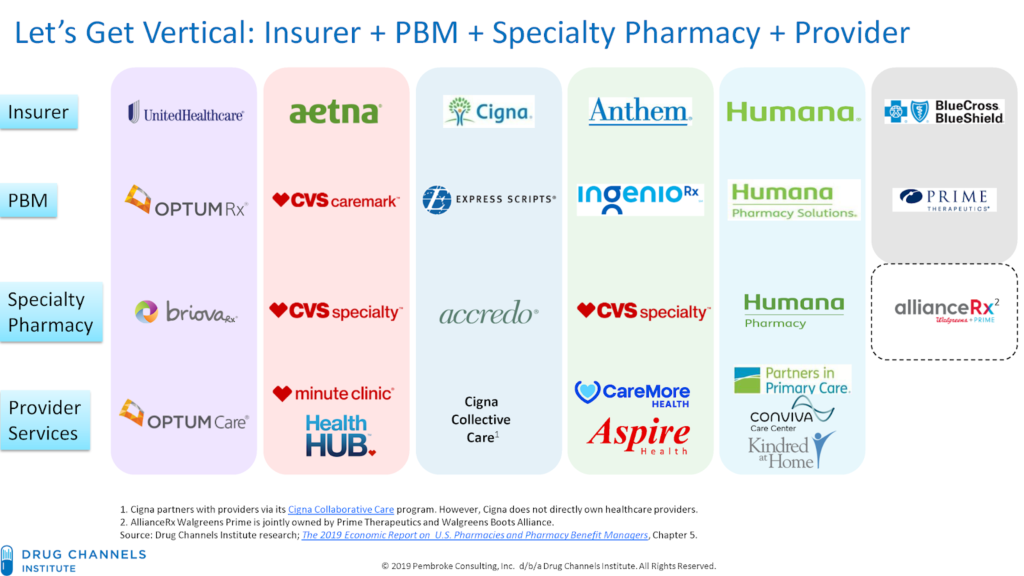

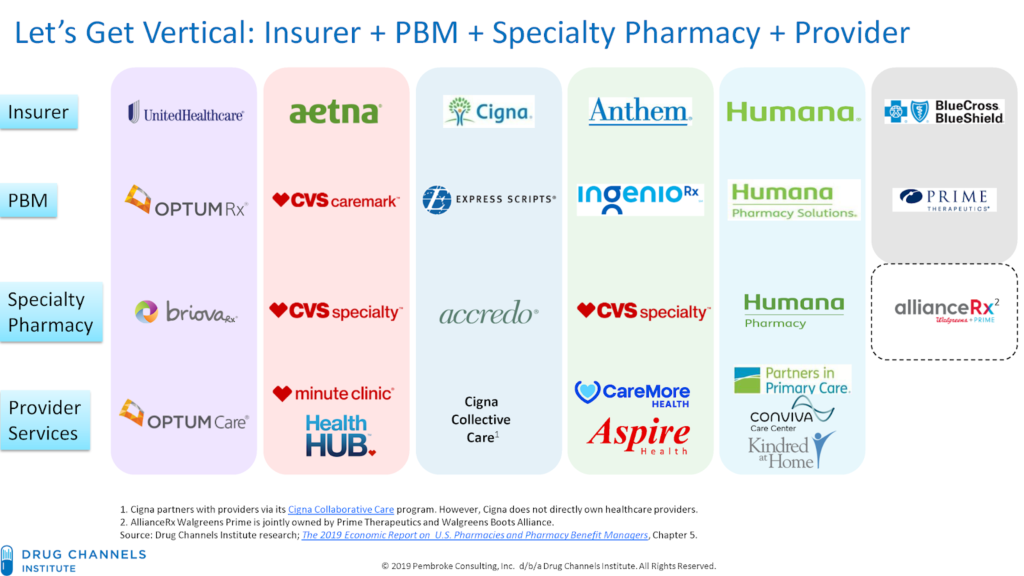

Known as vertical integration mergers, these deals have led to hyper-consolidation between health insurers, providers, pharmacy benefit managers (PBMs) and other sectors of the health care market. Today, three entities—CVS-Aetna, Cigna-Express Scripts and UnitedHealth-OptumRx—control nearly 80% of the PBM market. OptumCare, owned by UnitedHealth, now employs or is affiliated with 50,000 physicians and 1,400 clinics, and they anticipate hiring at least 10,000 more providers by the end of 2021.

While the emerging mega-companies have argued that mergers help consumers and purchasers by holding down costs, there is scant evidence that increased consolidation reduces inefficiency and waste, improves quality or decreases costs. On the contrary, evidence suggests market consolidation, including vertical integration, has contributed to rising costs and lower-quality care.

One recent study found that diagnostic imaging and laboratory referrals from physicians increased significantly after the physicians’ practices were acquired, boosting Medicare spending by $73 million during a four-year-period across the 10 imaging and lab services reviewed. Another study that examined claims data from 2009 to 2016 determined that the odds of a patient receiving an inappropriate MRI referral increased by more than 20% after a physician transitioned to hospital employment.

More aggressive oversight needed

The only solution to the problems posed by the increasing number of vertical integrations in the health care industry is more aggressive oversight and enforcement of anti-trust laws.

The federal government has begun to take steps toward the oversight needed. Guidelines issued by the Federal Trade Commission (FTC) and Department of Justice in June 2020 represent the first-ever vertical merger-specific guidelines and replace broader merger guidance published in 1984. Although vertical mergers traditionally have faced little scrutiny by regulators, the new rules may usher in a more aggressive chapter of anti-trust enforcement around the transactions.

In July 2021, the Biden administration signaled it was taking seriously risks associated with vertical mergers in a sweeping executive order aimed at increasing competition and reducing anti-competitive consolidation across multiple sectors. The order contains directives for the Justice Department and FTC to “enforce the anti-trust laws vigorously” with respect to hospital mergers. It also directs federal agencies to address consolidation in other health care sectors, including pharmaceuticals and health insurance.

In another positive sign, the Department of Justice sued to stop the merger of Aon and Willis Towers Watson, two of the nation’s largest insurance brokers. Though an example of horizontal, rather than vertical integration, the suit – which led to the two companies calling off the merger in July – demonstrates the administration’s skepticism of greater consolidation in the health care industry. As alleged in the suit,

Aon and Wills Towers Watson operate “in an oligopoly” and “will have even more [leverage] when [the] Willis deal is closed.” If permitted to merge, Aon and Willis Towers Watson could use their increased leverage to raise prices and reduce the quality of products relied on by thousands of American businesses — and their customers, employees, and retirees.

Health care mergers, whether vertical or horizontal, must benefit the people served by the entities involved. The federal government’s continued steps to strengthen anti-trust laws and closely review every proposed merger is essential to getting costs under control and ensuring Americans have access to quality health care services.

Addressing Market Failure: Lowering Health Care Costs for Americans

August 4th, 2021

The United States is facing a crisis when it comes to health care costs. Prices for lifesaving, necessary care and drugs are simply too high for consumers.

Recent surveys have found that roughly one quarter of people in the country find it difficult to afford their prescription drugs, and three-in-ten say they haven’t taken prescribed drugs due to high costs. For some, the cost of prescription drugs is literally a matter of life-and-death. By 2030, 112,000 seniors each year could die prematurely because drug prices and associated cost-sharing are so high that they cannot afford their medication.

In 2019, 158 million Americans received health coverage through their employer. That’s nearly half the total population as estimated by the U.S. Census Bureau. This means high costs also place significant financial burden on employers that provide health benefits to employees and their families. This comes at the expense of core business investments and holds down wages, dampening business growth.

Why are health care costs so high?

Health care industry consolidation is increasing the market power of dominant hospitals, health systems, physician groups and drug companies. This has enabled them to raise prices beyond what is reasonable or necessary in the commercial market.

Some hospitals, health systems and physician groups use their market power to bully health plans, employers and ultimately patients, into contract terms that drive up costs with no corresponding increase in value. An example of this is the ongoing lawsuit against Sutter Health in California. Sutter used its market leverage to force large companies and their insurers into contracts with terms that drove prices up but did not add value for the employers or their employees. A settlement, including a payout to the employers and injunctive relief, has been announced but is still pending final approval after a 10-year court battle. This will be a victory for these employers, and the suit – particularly its injunctive relief, which requires the health system to end its anti-competitive business practices – provides a roadmap for nationwide reform that could dramatically improve costs. We need wide-scale solutions to address the problem broadly, and cannot wait for decade-long court cases to solve this problem one health system at a time.

Yet, the problem seems to be accelerating. Between January 2019 to January 2021, hospital and other corporate entities acquired 20,900 physician practices, resulting in a 25% increase in corporate-owned practices. With the decrease in independent practices comes a decrease in the competition necessary to ensure healthy markets, allowing large corporate entities to use their market power to drive prices up for non-hospital care.

Further, through manipulation of patent and market exclusivity laws, including “patent evergreening” and “patent thickets,” pharmaceutical companies have thwarted market competition by keeping drugs under patent well past their original expiration. While prices of brand name drugs continue to rise, the pipeline of innovative treatments has begun to dry up. Today, 78% of drug patents are not for new drugs, but for minor changes to existing ones. Patents should encourage and reward innovation, not be used to discourage market competition.

What can we do about it?

There are two main ways to address the issues at the root of the ever-rising health care costs – strengthen anti-trust enforcement and prohibit specific anti-competitive practices.

Strengthening anti-trust enforcement

All federal agencies with the authority to enforce laws meant to promote free and open markets must do so to protect American consumers. The federal government has begun to take action to strengthen anti-trust enforcement. In President Biden’s recent executive order on promoting competition in the American economy, he directs the Department of Justice and the Federal Trade Commission (FTC) to enforce anti-trust laws vigorously.

The executive order also encourages the Department of Justice and the FTC to review the horizontal and vertical merger guidelines and consider revision. The guidelines should be revised to address the increased industry consolidation behind the rising costs of health care. Additional staff and resources are also needed to support the work of the federal agencies working to enforce anti-trust laws.

On the state level, regulatory bodies should closely monitor mergers and acquisitions to ensure they meet public benefit requirements, meaning they are beneficial to the communities in which the entities operate.

Prohibiting specific anti-competitive practices

Legislation that specifically regulates anti-competitive contracting practices should be prioritized by Congress and moved expediently. The Lower Health Care Costs Act, which was passed on a bipartisan vote by the Senate HELP Committee in 2019, specifically addresses anti-competitive terms in facility and insurance contracts that limit access to higher quality, lower cost care. This would address the issues with contracting practices used by health systems like Sutter Health to hold employers and health plans hostage. The bill is still awaiting a vote by the full Senate.

We must end the gaming of the patent system that allows drug manufacturers to reduce competition for expensive brand-name drugs. President Biden’s executive order on promoting competition also directs the Department of Health and Human services to take action on the cost of prescription drugs. Specifically, he directs the department to lower prices and improve access by promoting generic drug and biosimilar competition, ensuring patents incentivize innovation and are not used simply to delay the development of generic drugs and biosimilars, supporting the market entry of lower-cost generic drugs and biosimilars and preparing for payment models to support increased utilization of generic drugs and biosimilars.