4 Ways Employers Can Boost Vaccine Acceptance and Uptake

March 23rd, 2021

Employers have a critical role to play in helping end the COVID-19 pandemic by encouraging vaccine acceptance and uptake among their employees, including those most vulnerable to COVID-19, experts explained in a recent Purchaser Business Group on Health webinar.

“Your leadership really matters,” said Deb Friesen, MD, a physician advisor with Kaiser Permanente Clinical Solutions. “One of the things we’ve found is that your employees consider you the most trusted source of information related to the coronavirus, more credible than even government health organizations or the media. So, your role here is crucial.”

Friesen was joined in the March 17 webinar by Stephen Massey, managing director of the Health Action Alliance, a group formed to support employers in strengthening vaccine acceptance, advancing health equity and rebuilding public health.

“Even before all adults are eligible for vaccines, it’s important that companies begin preparing their workforce by sharing trusted information and making plans to reduce barriers to vaccination,” Massey said.

4 Steps Employers Can Take to Increase Employee Vaccinations

Friesen and Massey highlighted four steps employers can take to accelerate vaccine acceptance and uptake:

1) Spread a message of confidence and encouragement around vaccine safety and efficacy. It’s not so much that people are hesitant about vaccination; they simply need access to more trusted information about vaccines. Messages that encourage vaccination should focus on the importance of creating a safe environment for family, friends and co-workers, and emphasize that vaccines can help us all get back to doing things we love with the people we love.

Friesen also provided nuance about the vaccines that is valuable for people to understand and important for employers to include in their messaging: that when a vaccine is reported to have an efficacy rate of 95%, as with the Pfizer and Moderna vaccines, it means their chances of getting infected are decreased by 95% — not that those inoculated have a 5% chance of getting the disease. The studies on available COVID vaccines are demonstrating that each is incredibly effective, particularly when weighed against the annual flu shot, which in its best years is 40% to 60% effective at preventing disease. Significantly, each of the COVID vaccines currently available in the U.S. are 100% effective at preventing severe disease and the need for hospitalization.

2) Collaborate with community public health and health care partners to proactively engage workforce populations that may have unique concerns or questions, or who may need extra support accessing vaccines. Disproportionately lower numbers of Black and Hispanic Americans are receiving vaccines, despite their higher risk of infection, hospitalization and death from COVID-19. It is essential that employers develop targeted communications and policies to build trust and boost vaccine access among these populations. Engaging trusted messengers, including employee resource groups and other affinity networks, should be central to your strategy.

3) Make it easier to get vaccinated. Provide accommodations for vaccine appointments whenever possible for both full-time and part-time employees, contract workers and other personnel. Offer paid time-off and transportation to and from vaccination sites and childcare for employees who might otherwise be unable to schedule vaccine appointments. And as vaccine supply increases, consider engaging your local public health department and offering to host an on-site vaccine clinic at your place of business.

4) Take advantage of available resources. The Health Action Alliance has developed a wide range of free tools for improving vaccine acceptance and strengthening equity, including a sample communications plan, messaging for at-risk groups, peer-to-peer training and dialog and guidance for educating and engaging employees. Visit the organization’s website to learn more.

“At the end of the day, the most important thing any company can do right now is to share trusted information about the safety and efficacy of vaccines and make it as easy as possible for employees and workers to get vaccinated when it’s their turn,” Massey said. “By taking action to strengthen and accelerate the vaccine rollout, businesses can help turn the tide against COVID-19 and create a stronger, healthier future for everyone in America.”

2021 Health Policy Priorities: Bipartisanship the Only Path to Success

January 19th, 2021

Beginning on Jan. 20, Democrats will hold a “trifecta” – control of the White House, Senate and House of Representatives – for the first time since Barack Obama’s first term in 2009.

Democrats have signaled that they intend to pass major health care legislation this year. While health care legislation has been the flashpoint of major partisan battles in recent years – most notably the passage of the Affordable Care Act in 2010 and its attempted repeal in 2017 – there is a real window for bipartisan support on legislation focused on reducing health care costs and improving quality. Over the past decade, the rate of inflation for medical services has averaged nearly 3% annually – roughly twice the rate of inflation for all other products and services. Unsurprisingly, recent public polling demonstrates that lowering the cost of care for individuals is the most popular health policy among voters. As the largest purchasers of health care, large employers know well the impact of the relentless increase in health care costs on their businesses and on their employees.

Post-COVID 2021 Policy Priorities for Large Employers

Like policymakers, employers are focused right now on stemming and ultimately defeating COVID-19. Once the pandemic is largely over, they will look to policymakers to pivot quickly to directly tackle high health care costs, inadequate quality and stubborn inequity in health care. But that does not mean it will be easy. Truly addressing the underlying problems in our health care system means directly challenging entrenched interests that perpetuate the broken status quo. That’s why taking on these issues can and should be bipartisan in nature.

Large private employers and public health care purchasers will be watching the actions of the Biden administration and new Congress with special focus on the following issues:

1. Broken Health Care Markets

Our health care system is rife with economic distortions, including inadequate competition, opaque pricing, uninformed consumers and a lack of actionable measures of quality. Large employers are interested in the changes policymakers will make to strengthen competition and transparency. Where markets have failed entirely or where there is no market, federal policymakers have a responsibility to directly manage prices, with an emphasis on strengthening competition via:

- Stronger health care anti-trust enforcement, including prohibitions on anti-competitive practices, to address the problems of industry consolidation, market power and high prices.

- Price transparency at the individual, health plan and provider levels, including unveiling negotiated prices between providers and health plans.

- Policies to increase healthy price competition among brand name drugs, generics and biosimilars

In highly consolidated health care markets, where dominant health systems have already driven up prices, it may be impossible to reinstate healthy competition. This may be particularly true in rural areas with very limited numbers of hospitals and physicians. In such cases, the federal government should directly set or constrain prices for all purchasers at fair and reasonable levels.

For pharmaceuticals with no effective competition (including many brand-name drugs under patent and/or market competition) the federal government should negotiate fair and reasonable prices available to all payers, as well as institute caps on inflation for prescription drugs currently on the market.

2. Rapid Acceleration of Payment Reforms from Fee-For-Service to Value-Based Models

Policymakers have long recognized that the fee-for-service payment system promotes higher volumes of care without accountability for the quality of care or patient experience. It is time for leaders to insist on the rapid adoption of value-based payment models for both public and private payers.

Population-based payment models, as described in the Health Care Payment Learning and Action Network’s framework, are the best way to provide flexibility to physicians and health systems while ensuring accountability for the total cost of care. The payment models must also include accountability for quality, patient experience and equity.

In the wake of the pandemic and the rapid rise of and need for remote care options, it is important to note that population-based payment models provide the right incentives for the expanded and appropriate use of telehealth services.

3. Adoption of Robust Performance Measurement with Focus on Health Equity

The ability of our health care system to deliver higher quality outcomes depends on the adoption of standardized and mandatory performance measures. Such measures are essential to the widespread adoption of value-based payments.

Performance measures should include clinical outcomes, patient-reported outcomes, appropriateness and equity. And they should be standardized and required for all physicians, hospitals and other clinicians to provide useful comparable information to patients, consumers and purchasers.

For too long, however, health care quality measures have failed to address underlying racial, ethnic and other disparities in health care. Performance measures should include the capture of racial and ethnic identification data. Further, quality improvement initiatives should focus on areas of greatest disparities, such as maternal and infant care and COVID.

Each of the policies described has enjoyed bipartisan support in the past. With just 50 Senators caucusing with Democrats and a five-seat majority in the House, the most viable path toward legislative success rests on bipartisanship.

For more on what large employers are prioritizing in 2021, read 7 Large Employer Health Care Priorities to Watch in 2021.

5 Health Care Provisions in the COVID Relief Bill Impacting Employers and Families

December 21st, 2020

Over the weekend, congressional negotiators reached a deal on a more than $900 billion COVID-19 relief package. This legislation will be tied to a year-end government funding bill. Among the many provisions in the bill are several of particular interest for employers and health care purchasers.

Below is a summary of the critical items of interest:

1. Surprise Medical Bills

After a two-year legislative fight, Congress is poised to finally pass legislation to ban surprise medical bills.

Consumer protections: If a covered individual receives out-of-network care without their consent (whether in an emergency or non-emergency situation), the individual will only be expected to pay their normal in-network cost sharing amount.

Negotiation between providers, insurers: The remaining balance of the bill will be negotiated between the health insurer and the provider. The two parties will have 30 days to negotiate a mutually agreeable payment rate. If they fail to reach agreement after 30 days, either party may request an independent dispute resolution process (IDR). Under IDR:

- Both parties will submit a “best final offer” to an independent arbitrator.

- Both parties may submit additional information justifying their offer, but the arbitrator is banned from considering providers’ billed charges and the payment rate from public payers, including Medicare. Further, the arbitrator must consider the median in-network payment rate for the service in the geographic area.

- Using “baseball style” arbitration, the arbitrator must choose one of the two offers.

- The arbitrator’s decision is final. The losing party is responsible for payment of the IDR cost.

Most care settings affected: The surprise medical bill protections apply to inpatient hospitals settings and outpatient care in emergency departments, outpatient clinics and surgical centers and clinician offices. They also apply to air ambulance transport. Unfortunately, they do not apply to ground ambulance transport services.

2022 implementation: Protections against surprise bills will take effect for health plan years beginning on or after January 1, 2022.

Impact: The consumer protections included in the legislation will put an end to the scourge of surprise medical bills and reduce the ability of certain providers from driving up costs by implicitly threatening to bill patients if they are not included in insurance networks. However, there is concern that the IDR process may be “gamed” by providers and will be less successful at holding down costs for purchasers than the proposed alternative of a benchmark payment rate for surprise bills. Nevertheless, the Congressional Budget Office and other independent analysts believe that the legislation’s requirement that the arbitrator consider the median in-network payment amount will be effective at holding down costs.

2. Health Care Price Transparency

No more gag clauses: The final bill will ban “gag clauses” from health plan/provider contracts. These clauses prohibit plans from disclosing to plan sponsors and individuals’ financial information including the allowed amount and provider-specific negotiated payment amounts for items and services covered by the health plan.

Drug spending disclosures: The bill also requires annual disclosure by health plans regarding spending on prescription drugs, including the most frequently dispensed drugs, the highest cost drugs, the drugs with the fastest rising spending and the effect of drug rebates, fees and other renumeration plan premiums.

Impact: The ban on gag clauses in provider/plan contracts will provide meaningful, provider-specific information to plan sponsors and individuals regarding prices. However, Congress chose not to include accompanying legislation that would give plan sponsors the tools they need to use this information to stop dominant health care systems from engaging in anti-competitive behavior. This will, unfortunately, allow health systems to continue to drive up costs for purchasers and consumers without improving quality.

In addition, Congress chose not to include meaningful reform to the way in which health plans and pharmacy benefit managers (PBMs) purchase drugs. Previously considered legislation would have provided drug-specific price disclosures, discounts and rebates, and banned PBMs from engaging in “spread pricing,” in which the PBMs directly profit from rebates and discounts they negotiate rather than passing them onto plan sponsors. Instead, the final language in the bill provides only high-level aggregated information without a ban on spread pricing. It is unlikely the legislation will result in any change in behavior by PBMs and health plans.

3. Direct Economic Relief

Stimulus payments: Up to $600 per person in direct stimulus payments to individuals, phasing out for families with income exceeding $75,000.

Increased financial support: Enhanced unemployment insurance benefits of $300 per week for up to 11 weeks.

Help for small business: $240 billion for Paycheck Protection Program loans for small businesses, including non-profit organizations. Qualifying PPP recipients will need to demonstrate significant revenue losses in 2020.

Impact: The enhanced unemployment insurance and extension of the paycheck protection program will help struggling families and keep the economy afloat during the pandemic. However, Congress did NOT include COBRA subsidies for employees who have been laid off or furloughed – many of whom have joined the ranks of the uninsured since the pandemic began. These subsidies would have provided important financial support and medical continuity for families affected by job loss.

4. COVID Response

The bill provides additional fund for vaccines and COVID testing practices intended to help get the pandemic’s spread under control.

Vaccines: $20 billion for purchase of vaccine doses by the federal government; $8 billion for vaccine distribution

Testing: $20 billion for states to conduct testing and contact tracing

Provider relief: $20 billion in additional economic relief for health care providers.

Impact: The COVID response funding made available under this bill is critical to helping the country exit the pandemic as swiftly and effectively as possible – the necessary step to reinvigorating the economy.

5. Flexible Spending Account Rollover

The legislation allows flexibility for taxpayers to rollover unused amounts in their health and dependent care flexible spending arrangements (FSAs) from 2020 to 2021 and from 2021 to 2022. It also permits employers to allow employees to make a 2021 mid-year change in contribution amounts.

Impact: This provision gives employers and employees flexibility in managing unexpected changes in health care costs during the pandemic.

The New Political Landscape: 3 Opportunities for Employers to Shape Health Policy

November 6th, 2020

The outcome of the presidential race has ended with Joe Biden the new President-elect, and the potential of a split Congress. The new political landscape has significant implications for large employers and health care purchasers, PBGH policy experts explained in a members-only webinar the morning after the election, Nov. 4.

If Democrats and Republicans maintain control of the House and Senate, respectively, a continued partisan stalemate is likely. That means that major health policy changes are unlikely, according to Bill Kramer, PBGH’s executive director of Health Policy, and Shawn Gremminger, director of Health Policy.

Top Priorities for Large Employers

Opportunities nonetheless may emerge for legislative action. With a Biden win and Republican Senate – the most likely outcome given where the race currently stands – we see three areas of potential policy activity that could impact large corporations and the health benefits they extend to their employees:

1) Prescription drug costs: Employers are deeply concerned about high-priced drugs, and view this as a top issue. In fact, a poll taken during the post-election webinar found that 71% of employers feel that prescription drug pricing reform should be a top federal priority for 2021.

With a Biden administration and Republican-led Senate, it’s still possible that we’ll see movement on legislation improving transparency and even capping price increases. In addition, we could see limits on anti-competitive practices, such as pay-for-delay and other patent-related tactics, although they would face strong opposition from the pharmaceutical industry. These actions could lead to significant savings for large health care purchasers, and by extension, employees who receive health benefits on the job.

2) Surprise billing: This continues to be a serious problem, and there is bipartisan support to pass legislation to eliminate surprise billing. Congress has been deadlocked, however, on the best way to limit the prices charged by providers who have not signed a contract to be “in-network” with a health plan If we can find a way to break the stalemate and set limits using existing local, market-based contract rates, there would be real savings for employers and protections for patients.

3) High health care costs: High health benefit costs come at the expense of core business investments and hold down wages, dampen business growth and squeeze family budgets. The COVID pandemic and the related economic recession are making this growing crisis completely untenable as unemployment soars and many employers face existential threats.

Nearly 60% of employers who attended the PBGH post-election webinar said that policies to reduce health care costs beyond prescription drugs were a top priority heading into 2021.

Large employers would welcome action to accelerate the transition from fee-for-service to value-based payment models, which would help shift provider incentives from volume to quality and value. This could be accomplished by administrative action to introduce, test and spread value-based clinician payment and care models, especially for primary care.

In addition, health system consolidation has been a major driver of rising costs, and employers see a long-term benefit to stronger anti-trust enforcement and new prohibitions on anti-competitive practices, both of which are possible in the coming year.

Taking the Fight Against Rising Costs, Inequity Into Their Own Hands

Regardless of the ultimate makeup of the Senate, employers attending the PBGH post-election webinar identified several priorities they were likely to pursue on their own to stem rising health care costs, particularly in the wake of COVID.

Half (50%) said they planned to alter their company’s drug formularies to eliminate wasteful spending, and 44% said they intended to engage in value-based contracts to strengthen primary care. Another 50% indicated they would invest in methods to address inequities in care delivery and outcomes.

The days and weeks ahead will make clearer the configuration of our federal government post-election. We will have the opportunity to address the problems of high costs, inconsistent quality and racial disparities through administrative action as well as legislation, and the voice of employers will be an important influence in the upcoming health policy debates.

PBGH Chair Honored as Top Health Care Innovator

August 26th, 2020

Lisa Woods, Pacific Business Group on Health (PBGH) board chair, was honored August 24 by Modern Healthcare Magazine as one of the Top 25 Innovators for 2020.

Woods serves as Senior Director of U.S. Strategy and Benefits Design for Walmart Inc., the country’s largest employer. Her responsibilities include ensuring that 1.5 million Walmart associates and their dependents have access to comprehensive, affordable health benefits.

“We’re thrilled but not surprised that Lisa’s long-time efforts have been recognized,” said Elizabeth Mitchell, president and chief executive officer of PBGH. “Her track record of developing creative, comprehensive and effective solutions to extremely difficult problems, coupled with her genuine commitment to the health and welfare of Walmart associates, make her uniquely qualified for this honor.”

“All of us at the Pacific Business Group on Health feel fortunate to have the benefit of her experience, insight and judgment as we work to help America’s largest employers and health care purchasers reduce soaring costs without compromising quality.”|

Key innovations

Woods began her career with Walmart more than 30 years ago as a medical claims processer. Her duties steadily evolved and expanded to include claims auditor, architect of the retail giant’s claims processing system, and manager of the company’s research and development, fraud and abuse and customer service teams. In her current role, Woods leads the Walmart’s strategic benefit design efforts. Among her most significant innovations:

- Centers of Excellence: Walmart created a Centers of Excellence program that pays all expenses for employees and their families to have surgery at approved medical centers for transplant, heart or spinal surgery, or knee and hip replacement. The program’s results have been impressive: Walmart’s per- patient cost for joint replacements was more than $4,000 less than at non-COE facilities; one-fifth of patients avoided unnecessary procedures; all patients treated at COEs had three times fewer hospital readmissions and collectively were 70% less likely to be readmitted to the hospital. The program serves as a model which PBGH is working to replicate for the benefit of other employers nationwide.

- Increasing Access to Affordable Care: At the start of 2020, Walmart kicked off four health care benefit pilot programs aimed at expanding access to more affordable and effective health care services and lowering costs for employees and the company. The four pilots include a referral service using data analytics to steer patients to the highest-performing physicians, a free concierge service, $4 telemedicine visits and technology that enables patients to easily locate doctors with a history of providing high-quality care.

- Expanding Direct Contracting: Walmart has launched insurance products through direct contracting relationships with the nation’s top hospitals and health systems. By focusing on quality and making sure patients are directed to the most appropriate care and provider within a network, the program has saved money for the company and its employees.

Modern Healthcare noted that this year’s Top 25 Innovators championed scalable solutions being used to reshape health care in ways both big and small. While many of this year’s honorees pushed solutions that directly address the coronavirus epidemic, the magazine said, their innovations and approaches to problem-solving will be beneficial long after the crisis is over.

The full list of innovators and profiles of the winners are featured on Modern Healthcare’s site.

Many Large Employers Placing a Hard Stop on Return-to-Work Plans

August 18th, 2020

The majority of large employers are pumping the brakes on return-to-work plans in the face of the dramatic rise in COVID-19 cases, even as they continue looking for new ways to reduce health and social inequities for employees and their families. Those were the findings of a recent member survey conducted by the Pacific Business Group on Health (PBGH).

Respondents included 15 large employers that collectively provide health benefits to roughly four million employees and their dependents.

Onsite plans in limbo

According to the survey, 57% of companies say soaring numbers of COVID-19 cases have led them to put their return-to-work plans on hold until circumstances change. About 43% say they’re continuing to plan for bringing employees back to the worksite, but with multiple, enhanced safety measures in place.

Given the widespread uncertainty surrounding the upcoming school year, the vast majority of companies surveyed (82%) say they’re creating flexible schedules for parents with young children. About 18% say they’re providing additional childcare options through specialty vendors.

Reducing inequities

The survey also found organizations are taking a variety of actions to improve social and health equity. Specifically:

- 67% are evaluating benefits and health & wellness programs to ensure equity in access and use

- 80% of organizations surveyed say their C-suite and/or Board directors are calling for organizational-wide initiatives to address issues such as hiring policies, promotional advancement and compensation equity

- 67% are working with local communities in the areas in which they do business

- 33% are hiring a diversity and inclusion leader

When it comes to specific steps aimed at strengthening health equity through benefit design and health system strategies, companies are likewise pursuing multiple approaches:

- 57% are ensuring health plans reimburse providers for telehealth services

- 36% are increasing primary care access and services

- 21% are expanding and/or ensuring employee access to culturally representative health care providers

- 21% are requiring that health plans provide utilization and outcomes data by race, ethnicity, language, and sex

- 14% are expanding benefits for non-medical services, such as transportation and nutrition

- 14% are expanding access for providers (for example, in underserved areas)

Addressing social determinants

The survey illuminated a greater awareness of the barriers created by social determinants of health: 85% of respondents said they intended to place greater emphasis on financial insecurity, food insecurity, transportation and/or all of the above.

In gauging the adverse impacts of health inequity on employees, large employers worry most about behavioral/mental health (73%), primary care (47%) and chronic disease management (53%).

As for partnering with public health entities to address health inequities, 21% said they were engaged with public health officials in communities in which they work, while 29% said they were not currently doing so but considering it.

5 Pandemic Takeaways: Large Employers See COVID-19 as Catalyst for Systemic Health Care Change

July 8th, 2020

COVID-19’s long-term impact on U.S. health care remains unclear, but amid the ongoing turmoil and uncertainty, large employers see opportunities for much-needed reforms.

Elizabeth Mitchell, president and CEO of Pacific Business Group on Health (PBGH) and Lisa Woods, PBGH chair and senior director, U.S. Healthcare for Walmart, recently outlined five key takeaways from the pandemic during an online summit on the future of health care in a post-COVID world.

PBGH works with some of the nation’s largest employers in addressing health care purchasing challenges. Member organizations include 40 public and private entities that collectively spend $100 billion annually purchasing health care services on behalf of more than 15 million Americans.

Among the repercussions of COVID-19 from an employer perspective, according to PBGH’s Mitchell and Woods:

1. Telehealth is the future. Telehealth will continue to gain traction as a means of delivering appropriate care from a distance. Close to half of physicians are using telehealth in the wake of the pandemic, up from less than 20% two years ago. Analysts expect virtual physician visits will rise by 64% in 2020.

“We’re looking at ways to ensure that our associates can get the care they need in their home communities if they don’t feel comfortable traveling,” Woods said.

“We have been very focused on telehealth [at Walmart] and feel like it is the future,” Woods said.

2. Primary care needs more investment. With many primary care physician groups struggling due to fewer office visits triggered by concerns about COVID-19 exposure, fears are rising that provider consolidation will continue to accelerate, leading to ever-higher health care costs.

PBGH recently joined 35 other employer-focused organizations in urging Congress to impose a 12-month ban on mergers and acquisitions for health care organizations that received federal bailout relief. PBGH also is calling for immediate federal assistance for vulnerable primary care practices and the elimination of all or part of cost-sharing requirements for primary care visits.

Employers additionally want to see a greater emphasis placed on mental health and public health within the context of primary care and are looking for ways to positively impact social determinants of health (education, finances, food and housing insecurity, transportation).

“We haven’t been paying for the right things,” Mitchell said. “We’ve been focused on expensive tertiary care and elective procedures, and we need to focus on primary care. That’s how we keep people healthy and out of hospitals.”

3. Employers are hyper-focused on quality. “We know there are huge opportunities to identify how to get better outcomes, and we think purchasers are going to lead that charge,” Mitchell said.

Woods pointed to PBGH’s Employers Centers for Excellence as an example of the kinds of solutions employers will increasingly turn to in the pandemic’s wake. Through a rigorous evaluation and qualification process, PBGH has identified regional care centers that deliver high-quality elective surgical care for PBGH member-employees.

The centers were pioneered by Walmart and have been instrumental in helping PBGH members improve quality and reduce costs.

4. Employers want more control over contracting. Employers continue to be deeply concerned about health care costs that have been rising irrationally for years and worry the pandemic will fuel even higher prices.

Mitchell said financial pressure from COVID-19 has only exacerbated those concerns and will likely accelerate employer efforts to gain greater control of the health care purchasing process through direct contracting and other quality improvement and cost reduction efforts.

Direct contracting between employers and providers represents a promising solution, she said, because it creates an opportunity to “cut out the noise in the middle” to produce better and more cost-effective outcomes through collaboration between employers and providers.

5. The pandemic is forcing innovation. “[Employers] are going to be forced to innovate much more rapidly than they might have anticipated, because you can’t sustain a bloated, inefficient [health care] system in this environment,” Mitchell said. “The health care system didn’t fix itself, so employers are going to step in and fill that gap.”

In addition to boosting quality, Woods said eliminating unnecessary care—estimated to account for about one-third of all care provided—represents a key objective for employers. She noted that as providers ramp up from the pandemic-driven shutdown of recent months, it will be important to find ways to prevent unnecessary care from creeping back into the system.

The June 22-25 virtual summit during which Mitchell and Woods spoke was produced by Global Health Care, LLC, and included a wide range of presenters, from health plan and hospital executives to clinicians, educators and former policymakers. Their discussion can be viewed online here.

Large Employers Adapt Health Coverage in the Age of COVID-19

April 22nd, 2020

Large, self-insured U.S. employers are adjusting their health coverage to meet the challenges posed by the COVID-19 pandemic, a new survey by the Pacific Business Group on Health shows.

The survey includes responses from 21 jumbo employers that provide health benefits to approximately four million employees and their dependents nationwide.

Unlike companies that pay insurance companies to provide health care benefits, self-insured firms fund employee health costs themselves.

Among the survey’s key findings:

Employers are mixed about waiving costs for COVID-19 medical treatment: 45% of the non-high deductible plans offered by large employers responding to the survey are waiving cost-sharing for COVID-19 treatment; 32% of high-deductible plans are waiving cost-sharing; 80% of treatments via telemedicine methods are covered in full.

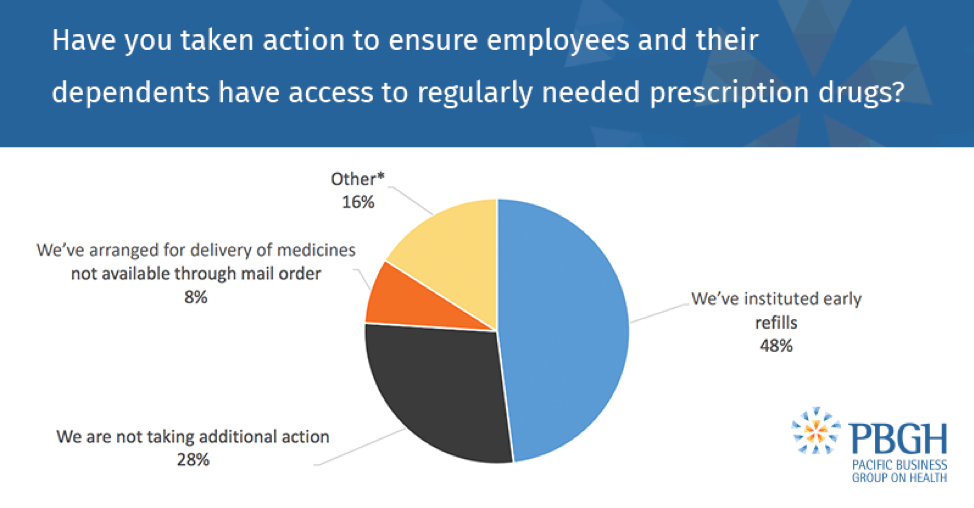

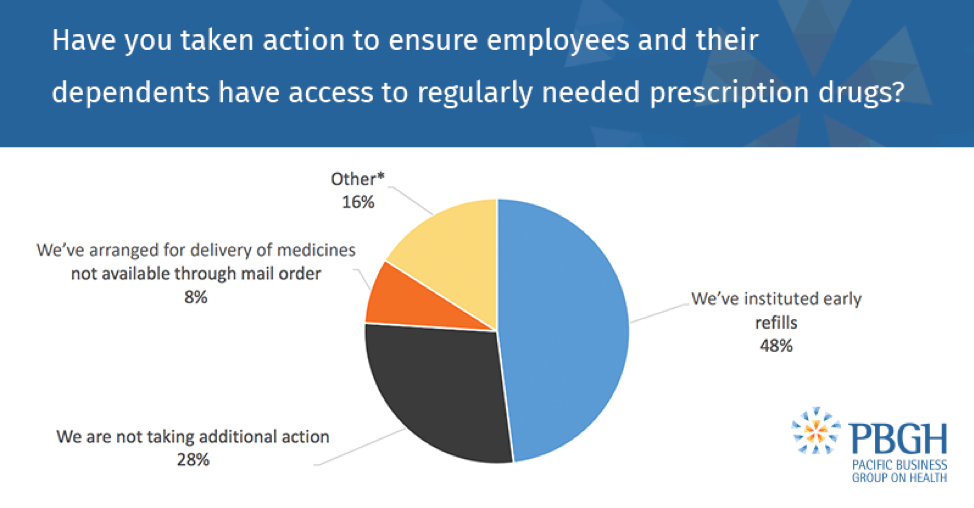

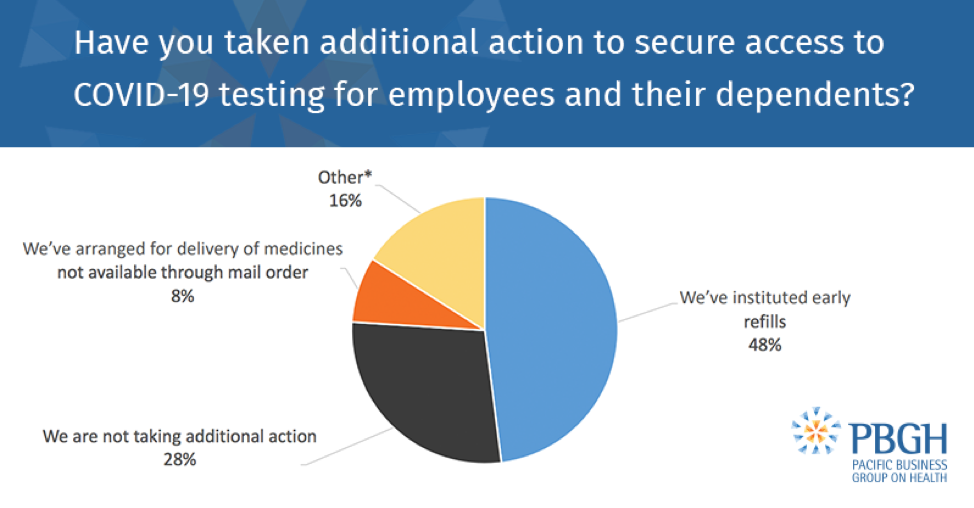

Prescription drug access is being prioritized: 72% of employers say they’ve altered their policies to ensure employees and their dependents have access to needed medications. Strategies include instituting early refills and arranging for medicine to be delivered to people’s homes if they’re not available through mail order.

Screening and testing via all methods is being covered in full: Althoughin-person testing with no cost-sharing is required by federal law for all health plans, the survey found that 100% of respondents are also opting to pay for telemedicine test screening with no cost-sharing.

Coverage for mental health services also are mixed: 61% of respondents are covering the cost of mental health visits via telemedicine, versus 20% doing the same for office visits.

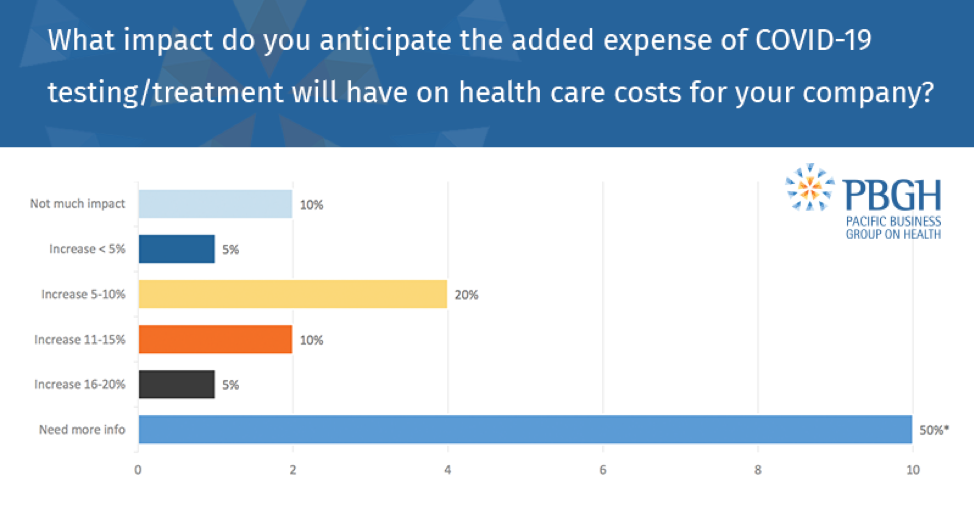

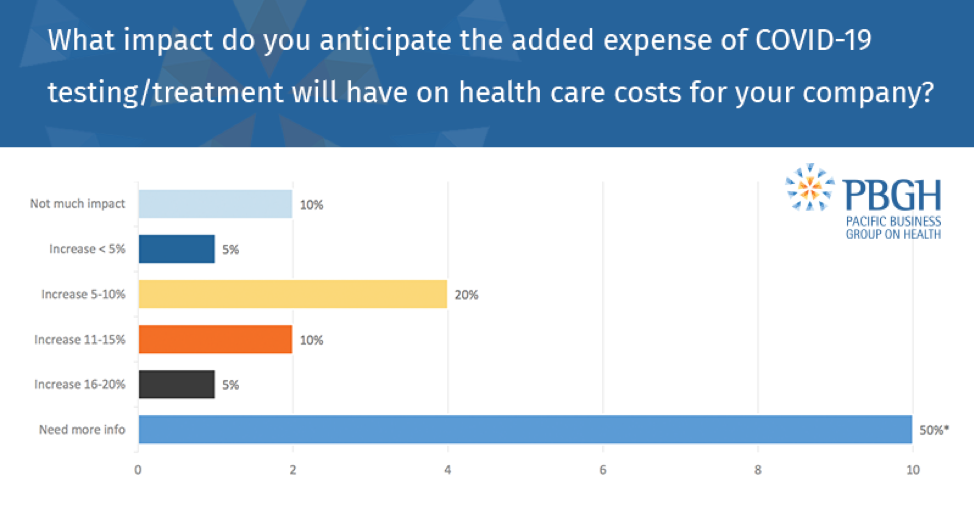

COVID-19’s ultimate impact on health care costs and premiums remains unknown: 50% of employers say they need more time to determine the likely effect of the virus on costs and premiums; 30% anticipate cost increases of 5-15%.

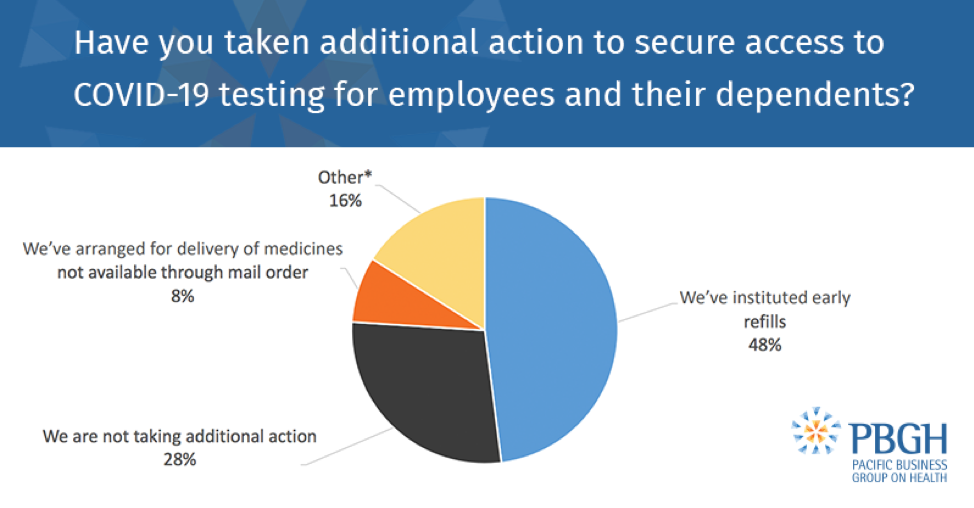

The survey also found that 67% of employers are offering COVID-19 testing onsite or at a near-site clinic.Those with onsite or near-site labs are taking various approaches to making testing available to their employees, such as purchasing tests from a vendor, offering lab services through regional medical centers at designated locations, and establishing a “fast pass” set-up with local hospitals to expedite testing appointments.

And they’re paying employees caring for sick family members and adjusting their time-off policies to do so. More than half of respondents said they’re using multiple approaches, including temporary or emergency pay as well as special leave policies.

Asked about their top three concerns relating to COVID-19, 81% cited worries about employees and dependents falling ill, while 67% said disruptions to business operations were a top concern. Among the large employers responding to the survey, 43% said increasing health care costs and a U.S. recession among their top concerns.

To learn more about how large employers are responding to the COVID-19 pandemic on behalf of their employees, read the full report.