Large, self-insured U.S. employers are adjusting their health coverage to meet the challenges posed by the COVID-19 pandemic, a new survey by the Pacific Business Group on Health shows.

The survey includes responses from 21 jumbo employers that provide health benefits to approximately four million employees and their dependents nationwide.

Unlike companies that pay insurance companies to provide health care benefits, self-insured firms fund employee health costs themselves.

Among the survey’s key findings:

Employers are mixed about waiving costs for COVID-19 medical treatment: 45% of the non-high deductible plans offered by large employers responding to the survey are waiving cost-sharing for COVID-19 treatment; 32% of high-deductible plans are waiving cost-sharing; 80% of treatments via telemedicine methods are covered in full.

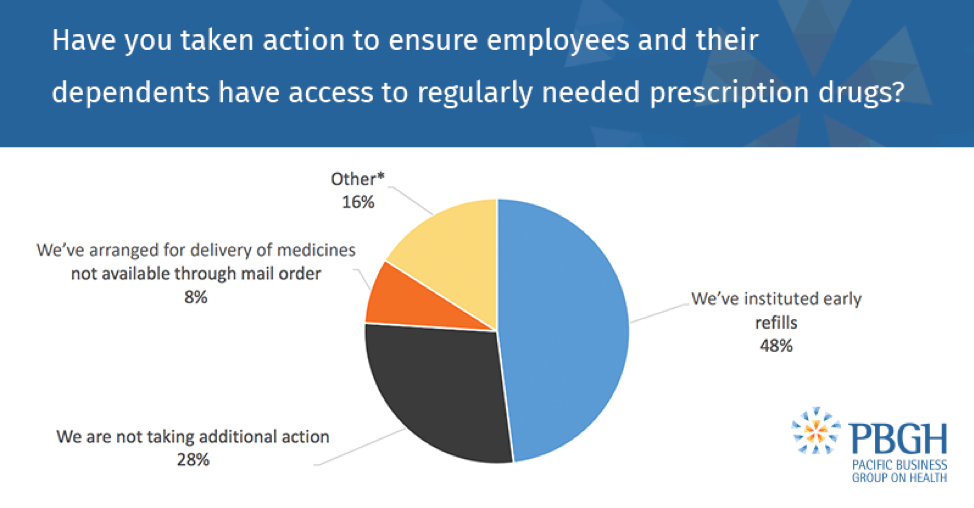

Prescription drug access is being prioritized: 72% of employers say they’ve altered their policies to ensure employees and their dependents have access to needed medications. Strategies include instituting early refills and arranging for medicine to be delivered to people’s homes if they’re not available through mail order.

Screening and testing via all methods is being covered in full: Althoughin-person testing with no cost-sharing is required by federal law for all health plans, the survey found that 100% of respondents are also opting to pay for telemedicine test screening with no cost-sharing.

Coverage for mental health services also are mixed: 61% of respondents are covering the cost of mental health visits via telemedicine, versus 20% doing the same for office visits.

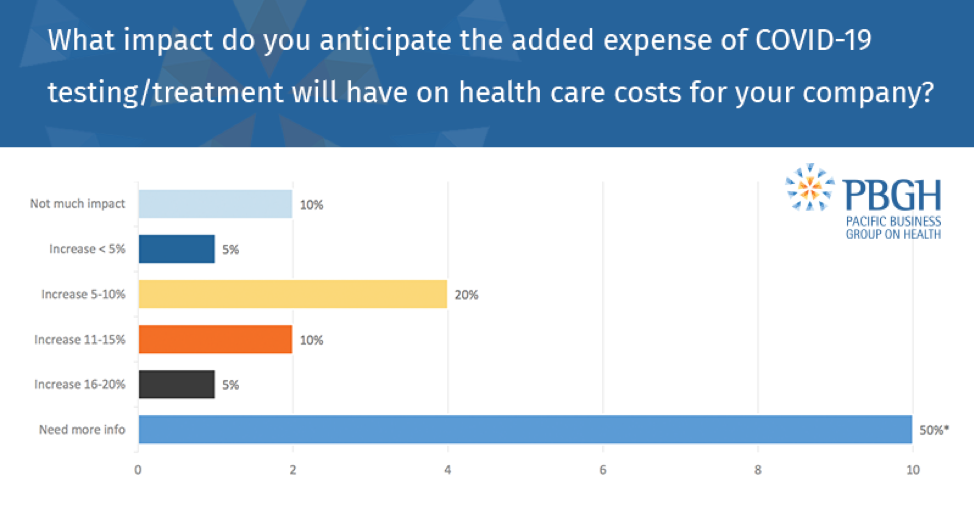

COVID-19’s ultimate impact on health care costs and premiums remains unknown: 50% of employers say they need more time to determine the likely effect of the virus on costs and premiums; 30% anticipate cost increases of 5-15%.

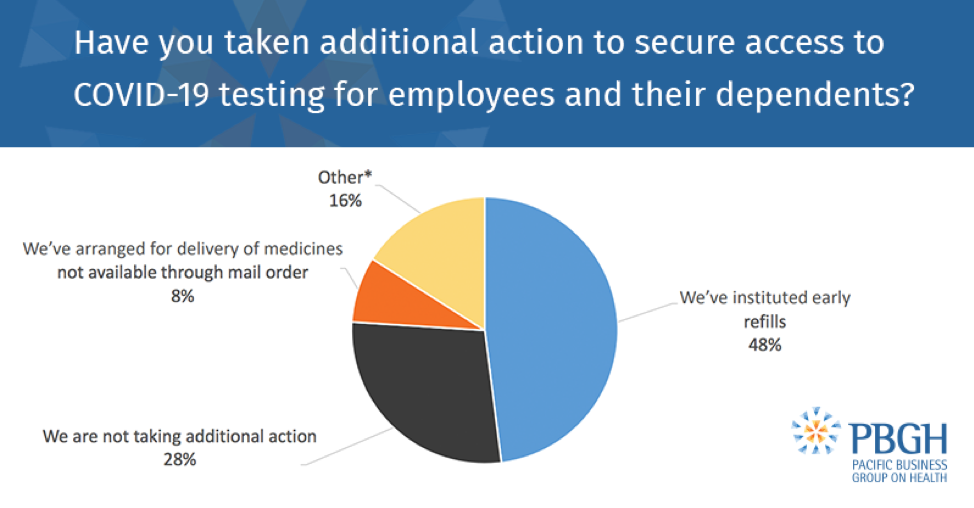

The survey also found that 67% of employers are offering COVID-19 testing onsite or at a near-site clinic.Those with onsite or near-site labs are taking various approaches to making testing available to their employees, such as purchasing tests from a vendor, offering lab services through regional medical centers at designated locations, and establishing a “fast pass” set-up with local hospitals to expedite testing appointments.

And they’re paying employees caring for sick family members and adjusting their time-off policies to do so. More than half of respondents said they’re using multiple approaches, including temporary or emergency pay as well as special leave policies.

Asked about their top three concerns relating to COVID-19, 81% cited worries about employees and dependents falling ill, while 67% said disruptions to business operations were a top concern. Among the large employers responding to the survey, 43% said increasing health care costs and a U.S. recession among their top concerns.

To learn more about how large employers are responding to the COVID-19 pandemic on behalf of their employees, read the full report.